When you raise funds to your enterprise through a banking facility, you have to pay some profit to the financing bank, in addition to associated service charges and fees. The following equation summarizes the essential components of Term Financing:

Total Financing Amount = Financing Amount + Bank’s Profit + Associated Fees

In this section, we will discuss the second component of the previous equation.

This is the amount of money made by the financing bank in return of offering and administering the facility for you. In the context of the Tawarruq process, Profit is the difference between the selling price you pay to MBSB Bank by the maturity date and the cost price, see My Journey with MBSB Bank.

MBSB Bank calculates the Profit as a percentage of the actually utilized funds on a daily basis. This percentage is the Effective Profit Rate (EPR). The profit is usually paid on a monthly or quarterly basis. Please note that since the balance of the Financing Amount decreases with your payments, the profit you pay also decreases.

It is important to realize that EPR does not necessarily remain unchanged during the entire financing term. This is because MBSB Bank applies a variable profit rate scheme, rather than a fixed one. This means the amount of Profit you have to pay may change during the financing term, see Financial Risks.

As a measure of customer protection, EPR cannot simply increase without a limit. The maximum value that EPR may ever rise to is called the Ceiling Profit Rate (CPR). CPR, thus, represents the worst case of your Term Financing.

EPR consists of two components: Base Rate (BR) and profit margin. BR is the minimum EPR that MBSB Bank may use in Term Financing. Remember that BR may change during your financing term. Profit margin is the additional profit component added to BR to make the EPR. Apparently, you are more concerned with EPR than BR.

This is the amount of money you will get through Term Financing. Based on your needs and the terms of the facility agreement, you may get this amount as a lump sum or over several disbursements according to an agreed upon schedule.

Term Financing does not cover the entire financial needs of your project(s). You have to pay a portion of these needs outside the financing facility. This Down Payment portion is usually 20-30% of the total needed funds.

During the Grace Period (GP), you are released of making payments towards the basic Financing Amount. You only need to pay the profit on a monthly or quarterly basis. GP is typically about two years, but may vary based on the terms of your financing agreement.

The Maturity Date refers to the date by which you must pay the total financing amount in full. On that date, profit payments will cease to roll in. Unsettled payments after that date will be considered default payments.

Financing Term, or Tenure, is the period for paying the total Financing Amount. In other words, it is the period between the first utilization of the facility and the Maturity date.

What does a customer gain/lose from prolonging/shortening the tenure? Apparently, a longer tenure gives you lower payment amounts that better fit your budget. On the other hand, a longer tenure increases the amount of Profit, and subsequently the total financing amount. Conversely, a shorter tenure saves you the extra amount of Profit associated with the longer tenure, but increases your regular payments. If your budget can support higher payments, most financial analysts think that you should opt for a shorter tenure.

Based on the needs of your project(s) and the financial status of your company, the schedule of receiving the financed funds and that of making the payments can both vary considerably. You may wish to receive the whole funds in a single payment, or you may prefer several disbursements based on the milestones of your project. It may also be more suitable for you to pay the Financing Amount in a bullet payment on the Maturity Date, or you may want to pay back the Financing Amount after a Grace Period or even from the very beginning of the financing term. In this section, the important aspects governing the process of making the payments are explained, followed by three examples describing the common scenarios of the process.

Once you receive some funds through the underlying facility, which marks the first utilization of this facility, you have to start making the profit payments associated with the actually received amounts. The due profit is directly proportional, via EPR, to the unsettled Financing Amount. This simply means that during the Grace Period, where no payment is made towards the Financing Amount, profit payments remain constant. Profit payments are usually made monthly or quarterly.

When you pay back the Financing Amount after the Grace Period, your payments naturally go to two components: the Financing Amount and the due profit by then. As previously discussed, profit changes depending on the balance of the Financing Amount. Nonetheless, your payments have to remain constant over the financing term, unless EPR changes. This is realized through Amortization. It is the process of spreading out the total financing amount into a series of fixed payments over the financing term. The Amortization formula calculates regular payments based on the Financing Amount, EPR, and the financing term. If you are curious to see the amortization formula, hover over the image below:

As previously mentioned, your payments pay two things: the Financing Amount and the profit. How much of each payment goes to each one? To answer this question, the following simple rule is introduced:

The underlying payment fulfills the due profit first, and the rest goes towards the Financing Amount.

In the following three examples, we assume that the Financing Amount is 10 M, EPR is 10%, and the financing term is 10 years.

The first example discusses the case of crediting the Financing Amount to the customer at the beginning of the financing term and paying it on the Maturity Date, see the figure below.

Since the Financing Amount is settled in one payment after 10 years, the profit payments remain constant throughout the financing term. Thus,

Annual profit amounts = 10 M x 10% = 1 M, and

Quarterly payments = 250,000

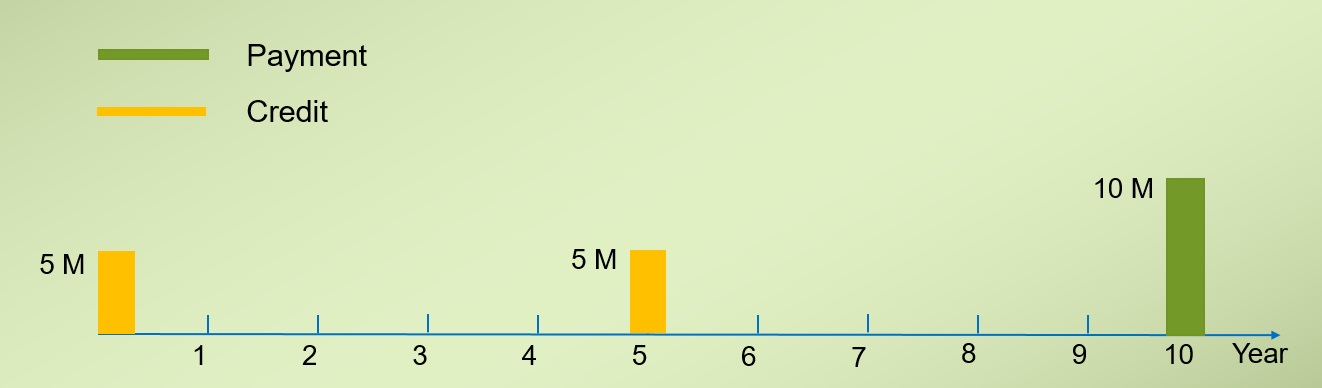

In the second example the Financing Amount is credited in two disbursements, at the beginning of the financing term and after 5 years, and it is paid on the Maturity date, as shown in the figure below.

Annual profit amounts in the first 5 years = 5 M x 10% = 500,000

Annual profit amounts in the last 5 years = 10 M x 10% = 1 M

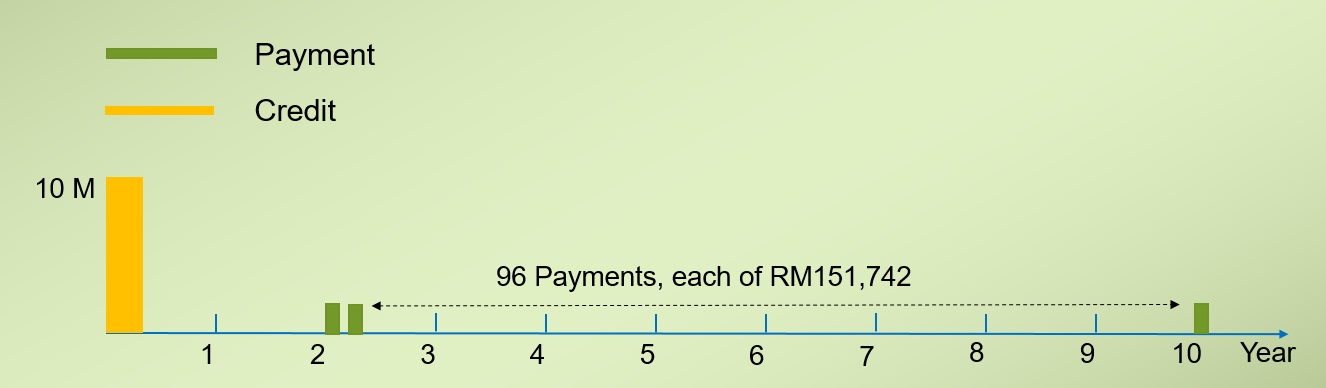

In the third example the Financing Amount is credited at the beginning of the financing term, and the customer is given 2 years of Grace Period, see figure below.

Annual profit amounts in the first 2 years = 10 M x 10% = 1 M

In the last 8 years (3rd till 10th year), monthly payments fulfill the profit of the current month, and directs the remainder of the payment to the Financing Amount. According to the amortization formula,

Monthly payments of the last 8 years = 151,742

P.S. If you would like to follow a numerical example of how monthly payments are divided between the Financing Amount and profit, please see Monthly payments of Property Financing.

You can save some money by using one of the following options:

5-year tenure |

10-year tenure | |

|---|---|---|

Monthly Instalment | 212,470 | 132,150 |

Total Profit | 2,748,226 | 5,858,088 |

As you know, Term Financing scheme follows a variable profit rate. If EPR rises, you will incur an additional profit for the remaining of your financing term. The following table lists the total profit for EPR of 10%, 11%, and 12% for a financing of RM10 M over 10 years. Respective Monthly instalments are listed too. Please note that it is assumed that EPR increased at the very beginning of the financing term.

EPR |

10% |

EPR goes up by 1% |

EPR goes up by 2% |

|---|---|---|---|

Monthly Instalment | 132,150 | 137,750 | 143,470 |

Total Profit | 5,858,088 | 6,530001 | 7,216,513 |

As you know, your total financing amount equals the total profit plus the Financing Amount.