Cashline is a corporate financing facility that provides cash based on quick notices. The Cashline facility is accessed through the PrimeRich Current Account-i. Holders of this facility can withdraw money beyond the available funds in this account, up to the credit limit approved under the facility. Like Revolving Credit, the previously paid portion of the Financing Amount can be withdrawn again. Cashline is periodically reviewed by MBSB Bank and usually renewed on a yearly basis.

Like other types of Corporate Financing, some profit has to be paid to the financing bank under Cashline, in addition to associated service charges and fees. The following equation summarizes the essential components of Cashline:

Total Financing Amount = Financing Amount + Bank’s Profit + Associated Fees

In this section, we will discuss the second component of the previous equation.

This is the maximum amount of money you can withdraw beyond the available funds in the account at any point of time. In other words, the Financing Amount is the credit limit approved under the facility. This amount can be used in a flexible manner. You do not need to utilize it at once, or to ever utilize it all. You can make several utilizations, each with the desired amount and at the suitable time. Additionally, you can utilize the available credit repeatedly within the Financing Term. Just make sure that every utilization is preceded with a 7-day written notice. The Financing Amount needs only be paid by the end of the tenure, unless the facility is renewed for one more term.

Please remember that an excess amount that goes beyond the credit limit at any point of time is considered a default payment that must be paid immediately.

In Tawarruq terminology, the Financing Amount corresponds to the Purchase Price, while the Financing Amount plus the maximum profit correspond to the selling price.

This is the amount of money made by the financing bank in return of offering and administering the facility for you. There are two types of Profit under Cashline: Profit on utilized funds, and Floor Profit Rate (FPR) on unutilized funds, which is significantly lower than the former one (about 1%). Both types of Profit are calculated on a daily basis and must be serviced at month-end, usually through being debited from the account. If Profit is not paid on time, it will be added to the utilized funds and rolled over to the next month. Profit of utilized funds is calculated based on the Effective Profit Rate.

MBSB Bank calculates the Profit of utilized funds as a percentage of these funds on a daily basis. The ratio of the yearly Profit of utilized funds to these funds (after dividing it by 100 to give the value in percent) is the Effective Profit Rate (EPR).

It is important to realize that EPR does not necessarily remain unchanged during the same financing term. This is because MBSB Bank applies a variable profit rate scheme, rather than a fixed one. Moreover, under the Cashline agreement, MBSB Bank, at its sole discretion, may change EPR on a case by case basis. Accordingly, the Profit rate you have to pay may change during the financing term, see Financial Risks.

EPR consists of two components: Base Rate (BR) and profit margin. BR is the minimum EPR that MBSB Bank may use in Cashline. Remember that BR may change during your financing term. Profit margin is the additional profit component added to BR to make the EPR. Apparently, you are more concerned with EPR than BR.

As a measure of customer protection, EPR cannot simply increase without a limit. The maximum value that EPR may ever rise to is called the Ceiling Profit Rate (CPR). CPR, thus, represents the worst case of your Cashline.

The Maturity Date refers to the date by which you must pay the Financing Amount plus all unsettled amounts of profit in full. On that date, profit payments will cease to roll in. Unsettled payments after that date will be considered default payments, unless the facility is renewed for one more term.

If the Cashline facility is renewed, you may rollover the outstanding balance to the new tenure. Please note that MBSB Bank may apply a different EPR figure in the new tenure.

Financing Term, or Tenure, is the period between the commencement of the facility and the Maturity date.

What does a customer gain or lose from prolonging or shortening the tenure? Apparently, a longer tenure gives you a longer time to re-utilize the available credit if you need to do so. As you hit the maturity date, you have to discharge all your financial obligations to avoid the consequences of being at default. A prudent financial management is imperative to avoid the temptation of unnecessary revolving of your balance, which could put you in a serious debt mess.

The following table summarizes the important differences of the two types of financing.

Cashline-i |

Term Financing-i | |

|---|---|---|

Financing Tenure | Short-term and revolving (renewable) | Fixed term |

Profit Rate | Usually higher | Usually lower |

Financing Scheme | Variable | Variable |

Recallable | Yes | No |

Revolving | Yes | No |

Early Settlement | Available | Available |

To understand the operational mechanism of Cashline, you have to be familiar with two terms: available credit and outstanding balance, or simply balance. Before utilizing the facility, the available credit is equal to the Financing Amount (credit limit) and the balance is zero. After utilizing the full Financing Amount, the available credit is zero and the balance is equal to the Financing Amount. Available credit and balance add up to a single number, which is the Financing Amount. At any point of time, no utilization can exceed the available credit.

Once the Financing Term starts, you have to pay Profit every month for the unutilized funds and the utilized funds, if any. As already mentioned, Profit of utilized funds is based on EPR and Profit of unutilized funds is based on FPR. If an amount of Profit is not settled at month-end, it will be added to the utilized funds, and thus decreasing your available credit.

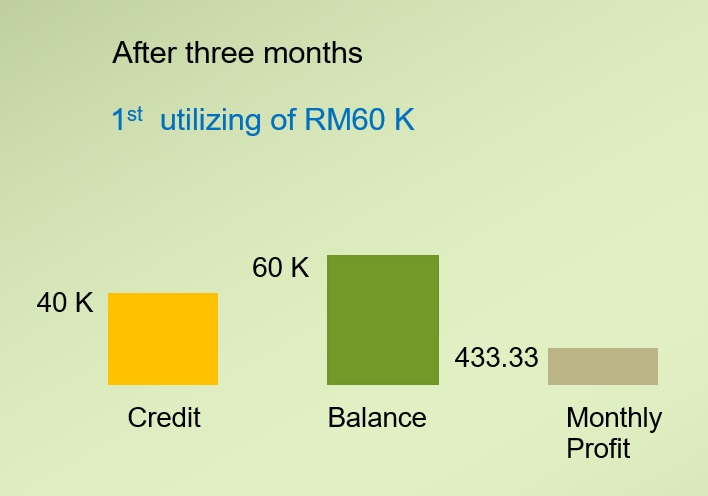

Suppose that Charming Flowers Enterprise has been offered a Cashline facility from MBSB Bank. The Financing Amount of this facility is RM100,000, EPR is 8%, FPR is 1%, and the tenure is 12 months. The following snapshots show how the available credit, balance, and profit change during the tenure. Calculations of Profit are made based on the assumption that all months are 30 days for simplicity.

Monthly Profit of the first 3 months =

100 K x 0.01 / 12 = RM83.33

Please note that the monthly Profit must be paid every month.

Monthly Profit of the fourth month and onward =

60 K x 0.08 / 12 + 40 K x 0.01 / 12 =

RM433.33

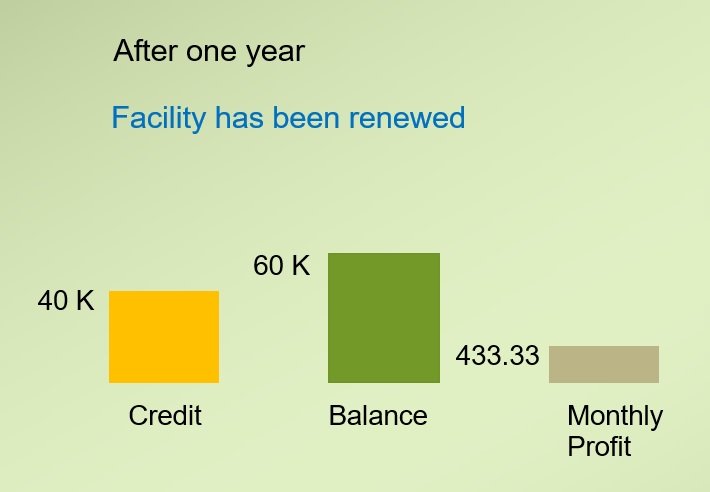

Since renewal has been approved, Customer does not need to pay the Balance.

Customer only needs to service the monthly Profit.

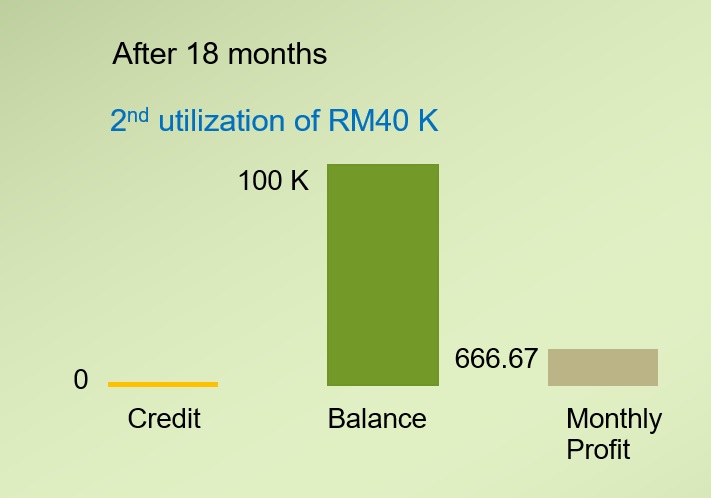

After making the second utilization, Customer stopped paying the monthly Profit.

Profit of the 19th month =

100 K x 0.08 / 12 = RM666.67

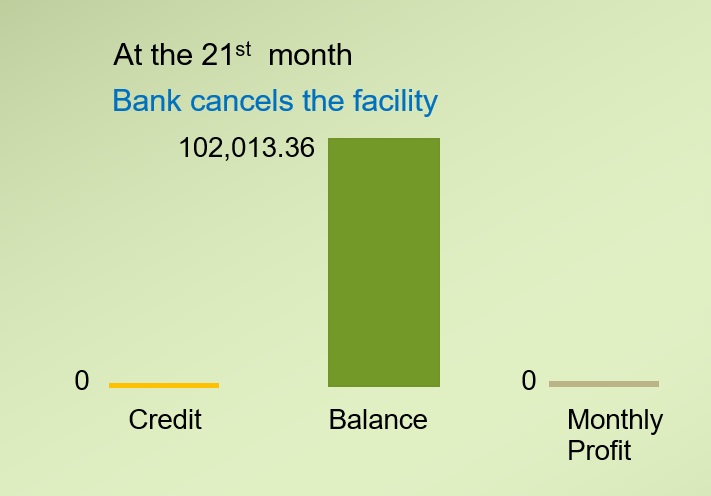

Profit of the 20th month =

100,666.67 x 0.08 / 12 = RM671.11

Profit of the 21st month =

101,337.78 x 0.08 / 12 = RM675.58

Total due amount upon cancelling the facility = RM102,013.36

You can save some money by using the following option:

Early settlement of the facility: Let us revisit the Case Study discussed above. If you keep paying the monthly Profit, and settle the facility after 21 months, MBSB Bank will release you from the Profit of the last three months, which is RM24,000 (8,000 x 3). This release is called Ibra’ (rebate). Of course, uncollected fees and service charges paid on your behalf by MBSB Bank will be subtracted from the rebate amount.

Despite the flexibility offered by the Cashline facility, the following risks have to be taken into consideration:

EPR Increase: As you know, Cashline scheme follows a variable profit rate. If EPR rises, you will incur an additional profit for the remaining of your financing term. The following table lists the total profit for EPR of 8%, 9%, and 10% for a full utilization of RM100,000 over 1 year. Calculations are made based on the assumption that EPR increased at the very beginning of the financing term.

EPR |

8% |

EPR goes up by 1% |

EPR goes up by 2% |

|---|---|---|---|

Total Profit | 80,000 | 90,000 | 100,000 |

What is particular about Cashline is that EPR may rise for more reasons than fixed payment facilities such as Term Financing. While EPR of both facilities may increase as a result of increasing the Cost of Funds, Cashline’s EPR may increase for two more reasons. First, the financing bank may increase EPR, at its own discretion, based on performance and your style of managing the funds. Secondly, upon approving a new term of the facility, EPR may change too.