Utilizing digitization in general, and Artificial Intelligence in particular, in improving the performance of Islamic banks and broadening the circle of their customers.

Developing advanced expert systems capable of representing and processing Islamic knowledge electronically, which enables making informed decisions, automation of processes, and the transfer of technical expertise.

Ahmed Mabrouk is a professor of Artificial Intelligence, and an author of Islamic finance and Islamic philosophy of science. He received his PhD degree in the Electrical and Computer Engineering from Boston University in 1998. His PhD dissertational work won the first-place award for the most innovative research work in Boston University in 1997.

Over the past thirty years, Dr. Mabrouk has worked for industry and academia in various technical and managerial capacities across three continents. He worked with Bell Labs Innovations, US, and Zarlink Semiconductors, Canada, on the development of microelectronic chips for wireless communications. He moved to Malaysia in 2003 and led the wireless broadband team in MIMOS Berhad, which developed the first multi-million gate system-on-chip in Malaysia.

Developing AI-based systems for Islamic finance is a major passion of Dr. Mabrouk, in pursuant of which he has founded SKILIK in May 2019. SKILIK's solutions are currently in use by several Islamic banks.

SKILIK Robo Advisory develops smart solutions for Islamic finance. Our solutions represent and process knowledge for smart conclusions. Whether you'd like to figure out the Shariah position of an issue, you are going through the approval of a product, you are trying to make sense of audit data, or you want to make your customers more educated about your products, SKILIK is your partner in achieving these goals. And best of all, our solutions do not exclude humans; they are designed to work with you and help you get the job done faster and more efficiently.

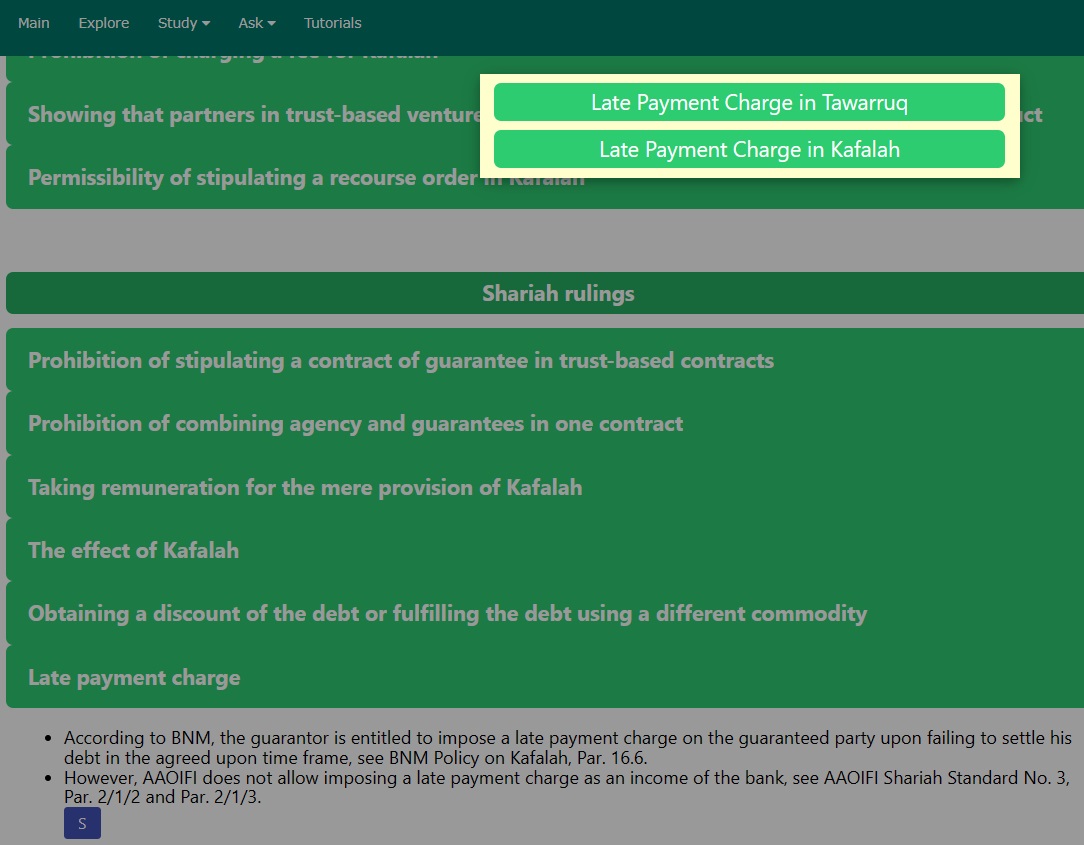

Hierarchical view of topics

Simple Definitions

Ontology

Pitfalls in Contracts

Verify Compliance with BNM-AAOIFI

Product Configurator

Chatbot

Legal Maxim Analyzer

Smart Advisor

Put your product together in few minutes

Gain access to Shariah resources and business flow

Explore related points

across the hierarchy

Have a dialogue with the Advisor

Get answers to complex scenarios

To speed up the process of approving financial products and to ensure their Shariah compliance

Shariah Committee’s members and product developers

Product Configurator

Semantic Navigation of Knowledge-Base

BNM resolutions and relevant fatawas

Check compliance with BNM-AAOIFI

Smart comparisons of legal and financial options

Smart advisor

Advanced Chatbot

To save the time of Shariah researchers through integrating all fatwa’s resources in a logical framework

Shariah Committee’s members

Rulings and views of various schools of thought

Quranic and Prophetic evidence with commentaries

Relevant fatawas

Analysis of Legal maxims

Smart Legal Advisor

Advanced Chatbot

To raise the satisfaction and awareness of customers through a smart interactive, educational system

Customers of Islamic Banks

Features of financial products and services

Visual Guide of the business flows of various products

Smart Advisor for financial planning and risk analysis

Simplified Guide of the financial and legal aspects of various products

To automate the process of internal Shariah audit via an interactive system

Shariah Committee’s members and Shariah Secretary

Automation of audit tasks

Statistical analysis of transactional data and compliance status

Fraud and anomaly detection

Automatic generation of compliance reports